Every month payment: The quantity you spend the lender on a monthly basis with the lifetime of the bank loan. Part of Every single payment goes to fascination and The remainder goes to your principal.

Your precise desire price and APR will depend on elements like credit rating, requested funding total, and credit history record. Only borrowers with excellent credit will qualify for the lowest price. Offers characterize cheapest regular payment for amount and phrase displayed. When evaluating gives, please evaluation the funding lover’s conditions and terms For extra particulars. All loans and also other money goods are topic to credit score overview and approval by our companions.

They're common curiosity prices based on A variety of credit rating score values, nevertheless, your particular person problem can differ, so to get Unquestionably certain about what kind of interest premiums you would probably receive for an unsecured particular mortgage, you ought to Examine features.

NerdWallet won't obtain compensation for our star scores. Study more details on our scores methodologies for private loans and our editorial pointers.

Is it easy to obtain a $1,600 mortgage? The convenience of obtaining a $one,600 financial loan relies on your credit rating as well as a lender’s particular acceptance specifications. Borrowers with bigger credit score scores usually tend to be accredited to get a broader choice of loans and with far better conditions. But specific lenders market to men and women whose credit history is to the reduce conclusion from the spectrum, which takes some guesswork outside of the appliance method.

Nonetheless, funding may perhaps acquire more time, and borrowers may need to pay for service expenses for the System facilitating the loan.

Try to find lenders who specialise in little loans, as they may supply better conditions. Go through testimonials from past borrowers and center on the Yearly Share Amount (APR) to grasp the accurate expense of the bank loan. Developing a side-by-facet comparison can assist you decide on the best choice.

Comparing loans can assist you discover the finest offer. What you want in order to avoid, however, is impacting your credit rating rating in the whole process of examining presents. On top of that, inquiring independently with a number of lenders is often time-consuming and leave your cellphone and e-mail getting advertising and marketing messages as lenders chase down your business.

Our star rankings award factors to lenders which provide consumer-friendly functions, which include: tender credit history checks to pre-qualify, aggressive desire fees and no service fees, transparency of rates and conditions, adaptable payment solutions, fast funding times, accessible customer care, reporting of payments to credit history bureaus and economical instruction. Our scores award less points to lenders with practices that may come up with a personal loan challenging to repay in time, for example charging large once-a-year share costs (previously mentioned 36%), underwriting that does not sufficiently assess shoppers’ ability to repay and not enough credit score-developing assist.

You could possibly also utilize a $1,five hundred unsecured personalized mortgage to purchase a washer and dryer substitution or a new equipment in the house that needs to be current.

There are numerous lenders from which to choose, but by utilizing a company like Acorn Finance, it is possible to look through mortgage presents from numerous lenders concurrently with out impacting your credit rating rating. If you prefer to work that has a lender you have already got a romance with, you can Examine to discover if they supply a web based application method. Some lenders make it possible for borrowers to accomplish the personal loan procedure from home.

Origination fee: The charge a lender costs whenever you get the loan to cover processing and administrative costs.

Immediately after checking your credit, it is possible to begin to shop about for a financial loan. It might be helpful to discover what your financial institution or credit history union has to offer, but it’s most effective to check probable possibilities from many lenders so yow will discover the ideal charges and conditions for you personally.

The desire charge you can expect from the lender for the $one,500 unsecured private loan is get more info completely depending on your personal credit rating. Personalized financial loan prices can also count on much more variables than credit history rating.

Luke Perry Then & Now!

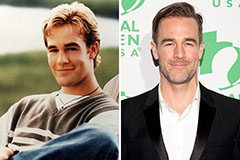

Luke Perry Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!